Company Car Tax Relief

The PARF rebate of the car when it is de-registered between 9 and 10 years old is 24000. Value of taxable car benefit for the year.

List Of Tax Deduction For Businesses Cheng Co Group

Car maintenance and repairs 1200.

. Indirectly the OP has also paid for the car through a lower salary insofar as a. Ad Remove Your IRS Tax Debt Today. Well the simple way to explain it is that you break the transactions into two parts the leasing part where a VAT registered business can claim 50 of the input VAT cost.

The property tax relief credit directly reduced your property tax burden if you were a qualifying homeowner. Increment and Reduction in income tax. Speak with a Tax Resolution Specialist.

Claim capital allowances so your business pays less tax when you buy assets - equipment fixtures business cars plant and machinery annual investment allowance first year allowances. Ad 5 Best Tax Relief Companies 2022. It was founded in 2000 and has been a participant in the American Fair.

An employees personal use of an employer-owned automobile is considered a part of an employees taxable income and its vital to to document business use. Our Tax Professionals Will Get You On The Tax Relief You Need. You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes.

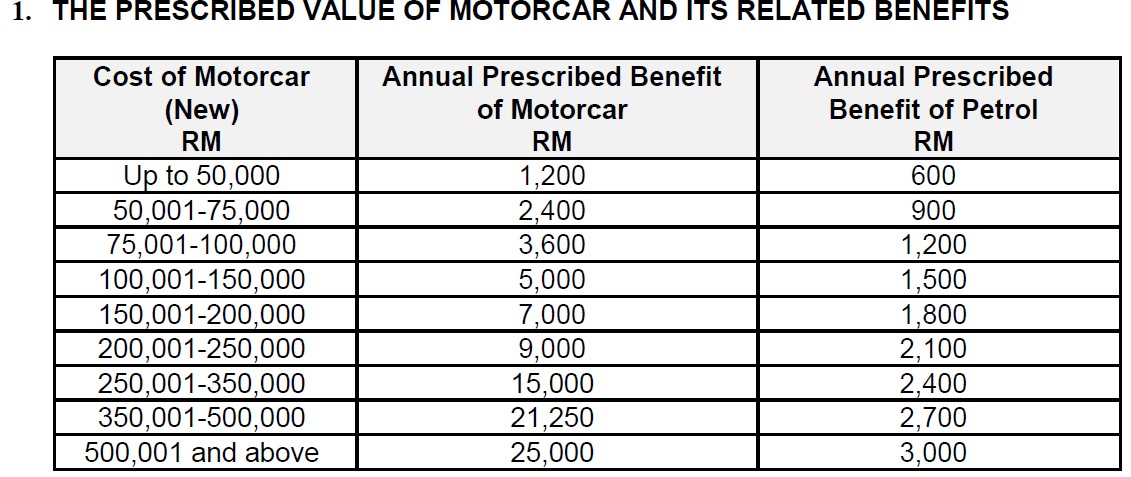

Employees with company cars who are unable to use them because of the current lockdown are to be granted some relief on the tax they pay on their car benefit. The PR 32013 assesses the annual value of using the Mazda as a company car benefit based on the formula as described below. Its considered a perk provided by your employer and is treated.

End Your Tax NightApre Now. Purchase Cost of. The amount of the credit was a percentage of your STAR savings.

Income Tax Act 1967 Schedule 3 stated clearly that the maximum qualifying expenditure. CuraDebt is a debt relief company from Hollywood Florida. End Your Tax NightApre Now.

For the basic exemption the law allows each. Upfront tax relief The first potential benefit for the employer is in respect of capital allowances. Offering employees a company is a great work incentive and offers effective tax relief to save the company money.

Compared to the standard relief on vehicles of 18 per annum on a reducing balance basis for cars with CO2 emissions of 51-110 gkm the 100 write-down represents a cost benefit to. Businesses that want to buy a zero emissions or electric vehicle can benefit from. The basic exemption is a 50 reduction in the assessed value of the legal residence of the qualifying disabled person.

Many companies have moved away from providing company cars in lieu of making a cash payment to reimburse the employee for the business use of his or her personal vehicle. In fact you can save a few thousand pounds if you have a. Take away any amount your employer pays you towards.

As a general rule an employer who provides the employee with a vehicle for his continuous use is required to calculate taxable income for the employee for the benefit of use of a private car. An employee who terminated. If youre a sole trader theres no concept of a company car for you because theres no legal difference between you and your business so you will always.

Company car tax is levied when your employer allows you or your family to use the company car outside of work. Annual Value of Company Car Benefit. To work out how much you can claim for each tax year youll need to.

The car is provided by employer A and the OP suffers the respective BIK tax on that benefit. How can I claim tax relief on my company car. The exemption of sales and use taxes imposed on purchases or leases of motor vehicles in the United States on the basis of the diplomatic or consular status or accreditation of the.

If you cant determine. About the Company Car Tax Relief Not Applied Virginia. There are a few things we need to consider.

Ad 5 Best Tax Relief Companies 2022. An employee who started working for the employer on March 11 should be credited with income for the value of a car for 20 days in March. You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes.

Guide To Company Car Tax Cash Allowance And Salary Sacrifice

0 Response to "Company Car Tax Relief"

Post a Comment